This is a sponsored post written by me on behalf of Navy Federal Credit Union for IZEA Worldwide. All opinions are 100% mine.

This college student budget template is an easy and effective tool for managing money in college. The college years are often the leanest years for most of us, making it the perfect time to learn to create and stick to a budget.

With one son through college with zero debt and another just starting her sophomore year, I’ve picked up lots of tips for college budgeting. I’ve also learned what types of expenses college students incur, since things have changed a bit since I was a college student on a budget.

Below I’m sharing everything I’ve learned along with a printable budget worksheet for college students and a college student budget template for those who prefer a digital solution. I hope these resources help your favorite college student spend less time worrying about finances and more time learning and enjoying the college experience.

College Student Monthly Budget

While a budget worksheet or template can be a helpful tool, it’s far more important to lay the right groundwork BEFORE plugging numbers into one. Here are a few things to do first.

1. Calculate expenses and income

The easiest way to make sure you cover all the potential college expenses is to use this Student Budget Calculator. It covers practically everything that a typical full-time college student may need to budget for and automatically calculates how much you’ll fall short or have in reserve.

Categories covered in the Student Budget Calculator include:

- School Expenses like tuition, fees, and books

- Food

- Living Expenses (e.g. rent and utilities)

- Professional Fees

- Entertainment and Travel

- Clothing

- Loan Payments

- Contributions and Gifts

- Savings and Investments

- Miscellaneous Expenses

- Personal Toiletries

- Transportation

The calculator includes examples for each of the categories above to help students account for as many expenses as possible in their budgets.

2. Identify Expenses You’ll Cover and How

I know parents differ when it comes to how much financial assistance they provide their children for college. My goal isn’t to persuade you which expenses to cover or not because I understand and appreciate those differences.

Instead, I want to help you provide whatever support you choose to offer in a way that is the most beneficial to your child. Because ultimately, our goal as parents should be to equip our children with the skills they’ll need to be successful adults.

For that reason, I think it’s ideal to let your child be the middleman between at least some of the transactions you’ll be paying on their behalf. My daughter’s college links her student ID to a payment account which I can load and reload with any amount I choose throughout the school year.

She uses this money to pay for postage, laundry, and toiletries. She has the freedom to make choices about when and how to spend the money, but I limit the amount by only loading a little at a time.

If your child’s college doesn’t have a similar plan, you can achieve the same results with tools like the Visa® Buxx Card. It’s a reloadable prepaid debit card that helps you and your student track spending together.

3. Establish accounts

If your college student doesn’t already have bank accounts, these should be set up immediately. At a minimum, a typical college student will need a savings account.

I encouraged my kids to open money market savings accounts to earn higher dividend rates. I hoped this would be an incentive to save more.

Your student will also probably need a checking account in order to write checks to pay certain bills. The Navy Federal Campus Checking account is a great option for those who are eligible since there is no minimum balance requirement and no monthly service fee. Even better, students can get up to $10 in ATM fee rebates per statement period.

If you aren’t already a member of Navy Federal Credit Union, it’s easy to join. Just click the following link –>> become a Member.

Also, make sure your student signs up for mobile banking. All my teens and college-aged children use mobile banking almost exclusively. Not surprising, given that this generation has grown up with mobile devices.

4. Credit Cards

The college years provide a great opportunity, and equally great risk, when it comes to establishing credit. If used wisely, a young adult can graduate with established credit and a decent score. In contrast, abusing credit cards can sabotage a young person’s credit for years to come.

Choosing the Right Card

A great way to practice responsible use AND leverage the benefits of a credit card is to use one designed specifically for new users like the nRewards® Secured Card from Navy Federal.

With an nRewards Secured Card, you can designate a specific amount from your savings account to establish your credit limit, while earning points for purchases made with the card. This way, a new user can safely build credit while keeping a handle on spending.

Use Credit Only for Specific Types of Purchases

One helpful tip I use often when it comes to credit cards is to set rules for the types of purchases for which I can use them. For example, I have one card that I use solely for gas so I can keep tabs on my fuel expenses and earn discounts at my local gas station.

Since my college-aged kids only have one card, I suggested that they use them for their recurring monthly expenses that they’ve accounted for in their budget. This way they can set up autopay for those bills to avoid late fees, earn points on their cards each month, and build good credit by paying off the balance in full each month.

In general, I discourage them from using their credit cards for impromptu purchases or dining out. In my opinion, those are the types of expenses that sneakily and quickly add up. Thus, they’re prime opportunities for racking up credit card and interest charges.

Printable Budget Worksheet for College Students

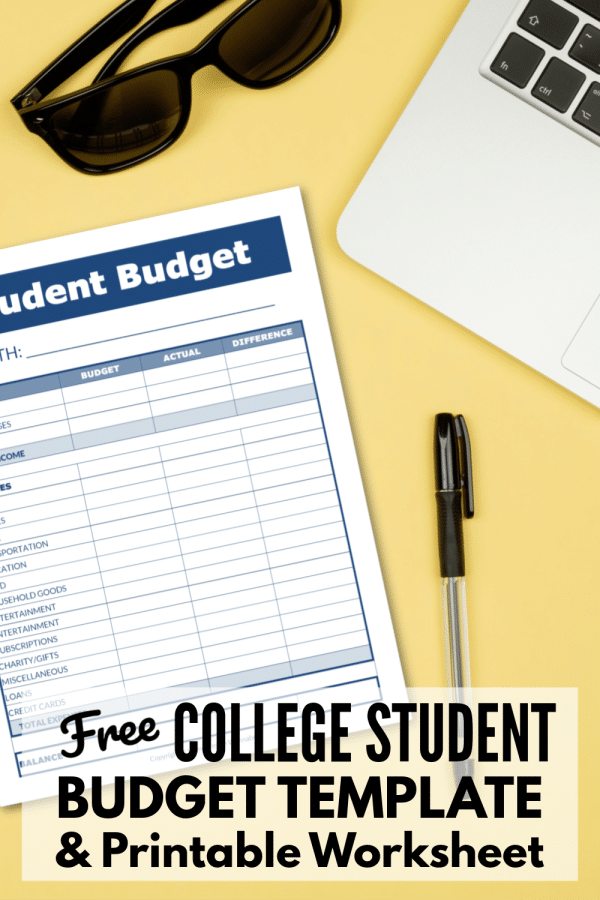

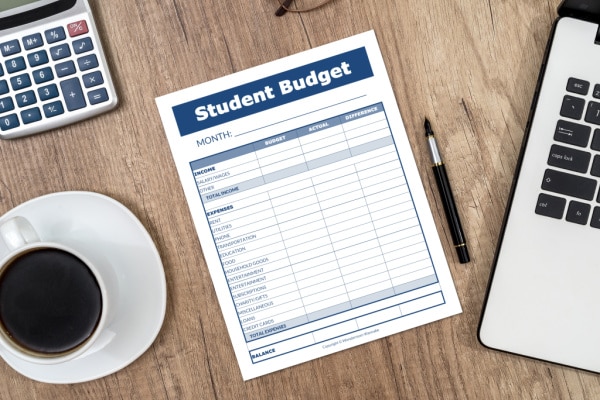

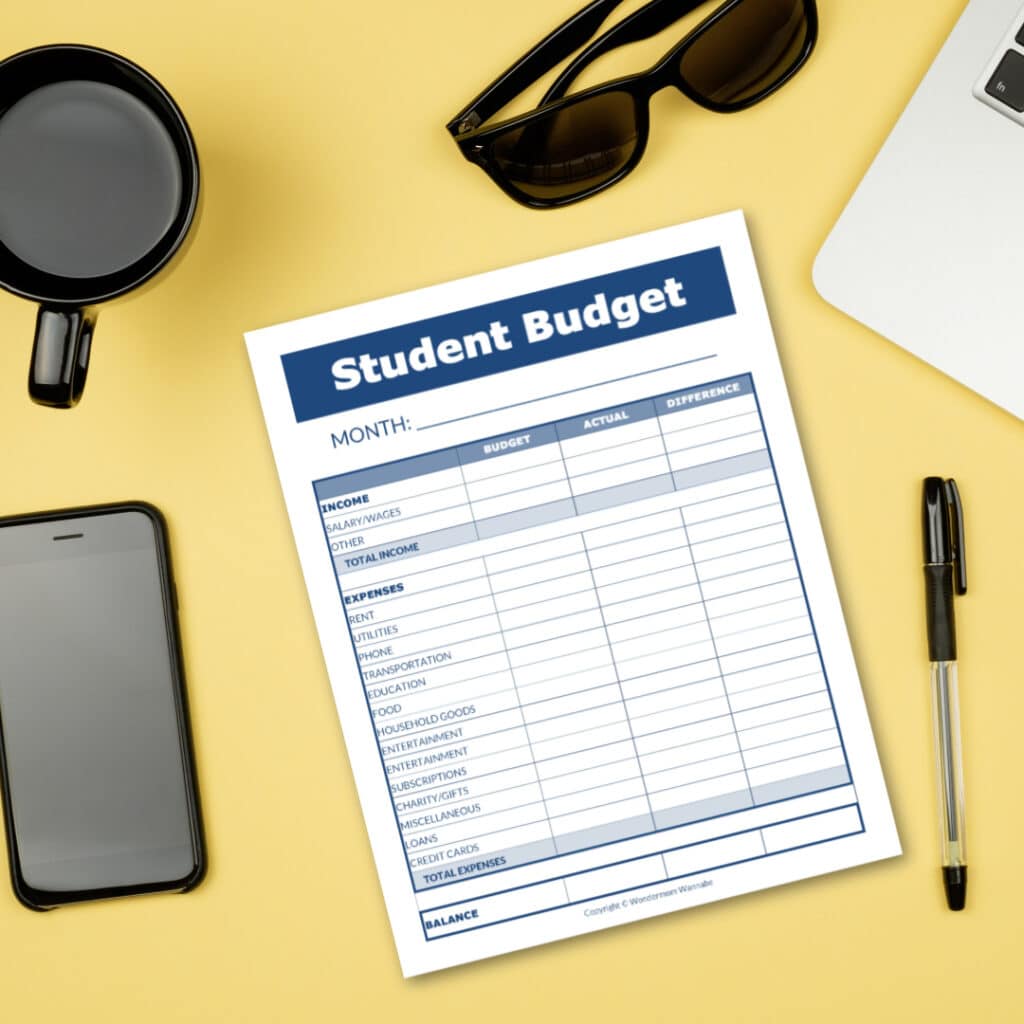

I’m a pen and paper kind of girl so when I first sat down with my daughter to work on her budget, I created this college budget worksheet. Plus, I think there’s something about writing down the amounts you’re spending that make the numbers more significant than digits on a screen.

This budgeting worksheet for students is simple and straightforward to encourage regular use. It’s more general than the Student Budget Calculator I recommended above so I suggest using that first to identify all potential expenses to give you better numbers to start with here.

Click the image below to open the printable budget worksheet for college students. You can save and/or print for personal use as often as you like.

College Student Budget Template

As I mentioned earlier, my kids prefer mobile solutions. So, though I started my daughter with the printable budget worksheet above, I also created a digital version for her to use as well.

The file is created in Google Sheets. Once you open the spreadsheet, click “File” and then “Make a Copy” to create a copy you can edit.

With the tools and tips above, any college student can be on the road to long-term financial stability and good money management. The earlier these skills are mastered, the more stability and freedom can be enjoyed in the future.