This is a sponsored post written by me on behalf of Navy Federal Credit Union for IZEA Worldwide. All opinions are 100% mine.

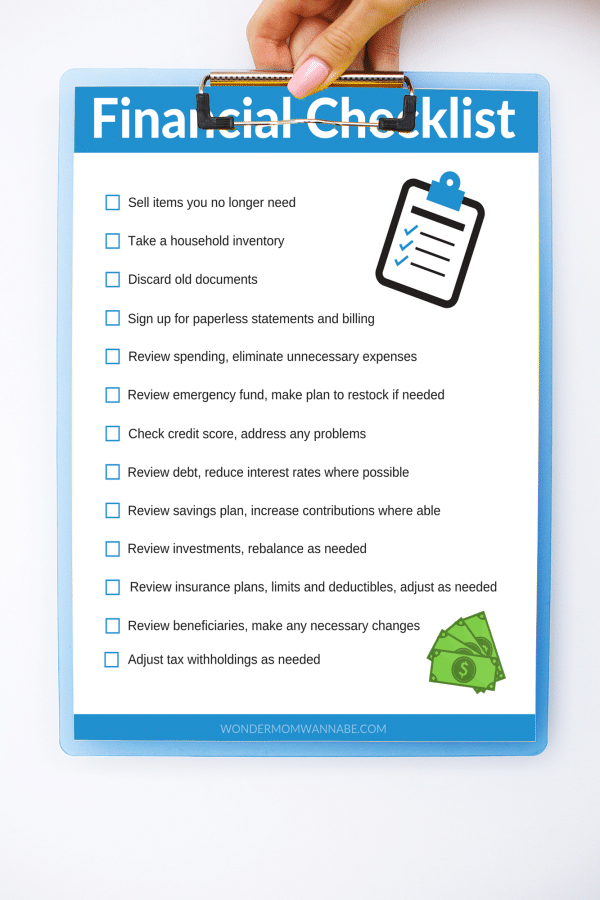

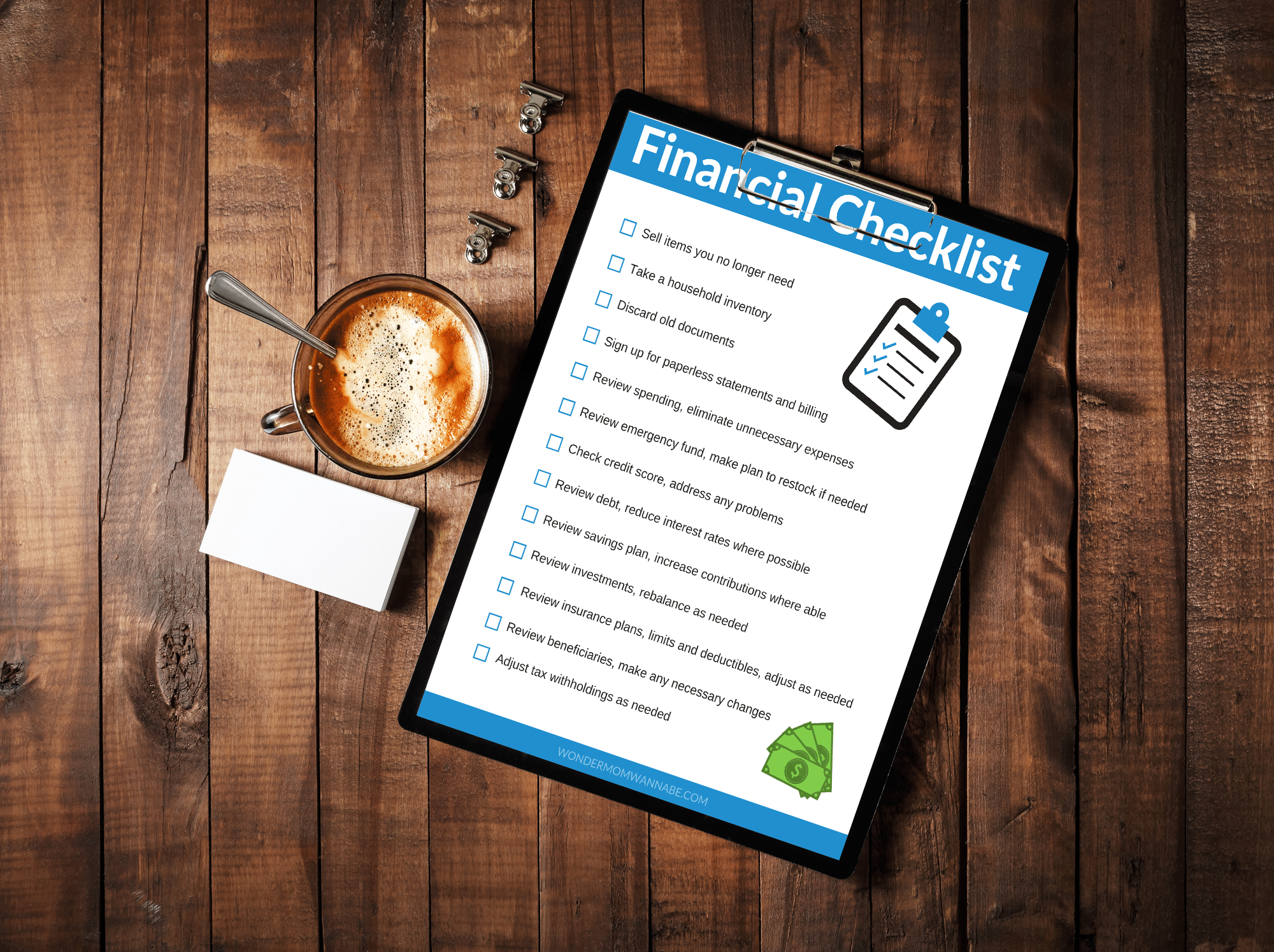

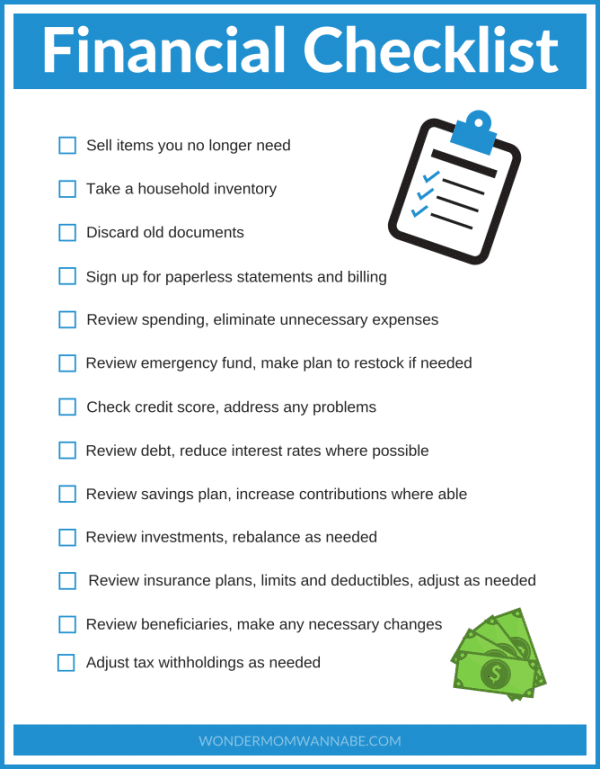

I created this Financial Checklist to provide a quick and easy way for you to spring clean your finances. It’s hard to stay on top of everything in a busy family life which is why when we find moments of inspiration or momentum, it’s a great idea to roll it into as much as we can.

The start of a New Year is usually a great time to re-evaluate if everything in your life is running according to plan. But, because life happens, by March we’ve usually fallen back into bad habits. That’s why the onset of Spring with all the signs of rebirth around us, often inspires us to find another burst of energy.

So, take some of that Spring cleaning passion and turn it towards your finances. A quick review of your financial life, along with a few financial housekeeping tasks, will yield great benefits in the long term and provide you with peace of mind.

Financial Checklist to Spring Clean Your Finances

Farther down you’ll find the free printable financial checklist, which is designed to jog your memory about important personal finance tasks. Here’s a detailed description of each checklist item so you know EXACTLY what to do for each step.

Sell Items You No Longer Need

If you’re in Spring cleaning mood, you might as well add to your bank account while you clear away clutter. There are several ways to make money while you declutter, including hosting a yard sale or selling items online.

Take a Household Inventory

We all hate taking pictures of our home when it’s a mess, so the perfect time to do it is after a major spring cleaning! Go room-by-room photographing furniture, wall hangings, and valuables.

Upload the photos to a cloud drive and also create a spreadsheet or document that lists all of your personal items. This way, if your property is ever stolen or damaged, you’ll have a ready source of information and evidence for your insurance company.

Discard Old Documents

Right after you’ve filed your taxes for the year is a great time to dig into the file cabinet and get rid of older returns and financial documents you no longer need. For IRS purposes, you should keep your tax records for AT LEAST the last 3 years.

If you claim losses for investments or debts, keep them for 7 years. Hold on to any loan documents until you’ve paid off the loan and have proof of payoff.

And there’s really no reason to hold onto bank or credit card statements and receipts after your monthly consolidation unless you need them for your tax return. Make sure to shred your documents, rather than simply throwing them away.

Go Paperless

Save yourself from the step above in future years by signing up for electronic statements and billing. Also, sign up for Bill Pay to send and schedule virtual payments easily. It’s easy to do, but is a task we often set aside for later. Do it now while those paper cuts from going through your old documents are still fresh.

Review Spending

Just like eating healthy and exercising, we go through cycles with spending. We’ll set a great budget and really stick to it for a month or two before sliding into bad habits. A periodic review of our spending habits helps get us back on track and identify areas of waste. If you’ve picked up any new subscriptions or membership fees that aren’t bringing you value, go ahead and trim those now.

Review Emergency Fund

We all know the importance of having an emergency fund. It’s a relief when we hit a financial hardship and have it there to cushion us. It’s helpful to evaluate how you’ve used your emergency fund over the last several months.

Is it a sufficient amount to cover hardships? Have you replenished it since you drew on it last? Have your income and/or expenses changed? If so, you may need to adjust the amount you keep in your emergency fund.

Check Credit Score

It’s always a good idea to keep an eye on your credit score. Navy Federal Credit Union lets you check your FICO score free at any time if you are a primary cardholder. If your credit score check reveals any problems (e.g. high balances, missed payments), make a plan to correct them and boost your score.

Review Debt

Make sure you’re on track when it comes to paying down debt with a quick review.

Is there an opportunity to reduce the interest rate by refinancing or a seasonal offer? Are you making more than the minimum payment on your credit card debt? Are you paying off your highest interest debt first?

Make sure your plan for dealing with debt is on track and make any necessary adjustments.

Review Savings Plan

An occasional review of your savings plan will help you save more over time. If your emergency fund is fully funded, you can start a new savings account for other goals (e.g. vacation fund, holiday shopping). Or, you can open a certificate of deposit to earn higher interest on your extra monthly funds.

Review Investments

While you shouldn’t make knee-jerk reactions with your investments, it is a good idea to do an occasional review to make sure your portfolio is well-balanced and that your money is working for you the way you intend.

Also, since contribution limits often change over time, make sure you’re fully funding your tax-sheltered investments (e.g. retirement accounts and 529 plans) to take advantage of the additional savings. If you have a financial advisor, this step might be a simple conversation to make sure your financial plan is on track.

Review Insurance

When we first get insurance, it’s usually during major life events (a new home, a new vehicle, the birth of a new child). We’re focused on the event that required the insurance and thus, aren’t always fully focused on the details of the insurance plan.

Plus, as time goes by, our preferences and financial situation change. Maybe you’re more comfortable with a higher deductible now. Or perhaps you realize you need more insurance or higher limits.

Do a quick review of all your policies (life insurance, auto insurance, homeowners insurance, renters insurance, health insurance) and make sure you’re comfortable with the coverage and premiums. If you’re not, look at some other options and make any necessary changes.

Review Beneficiaries

While you’re evaluating your insurance and investments, double check your designated beneficiaries. Unless you’ve had major life changes, these likely won’t change, but you might realize that the investment you started before you were still married has your college roommate listed as the beneficiary. It doesn’t take much time to double check your beneficiaries if you’re already poking around in your financial documents and accounts. So, take the extra few minutes and make sure they’re set up the way you want.

Adjust Withholdings

A Spring financial assessment is the perfect time to make changes to your withholdings. Since you recently filed your taxes, you have a really good idea if you withheld too much or too little last year to help with your tax planning for this year.

If you got a huge refund, you’re withholding too much so submit a new W-4 with a lower withholding allowance. If you had to make a payment with your tax return, you may want to increase your withholding to avoid making a payment next year.

Printable Financial Checklist

Print off the checklist below to help you Spring clean your finances. Simply check off each item as you complete it!

In addition to spring cleaning, it’s also a time to honor and thank military members. Are you in the military or related to someone who is? If so, check out all the wonderful ways Navy Federal Credit Union is celebrating Military Appreciation Month this May. Visit navyfederal.org/celebrate to see all the special offers.