The start of a new year is the perfect time to reflect on and organize all areas of our lives, and one crucial area we need to focus on is our finances. To make things easier, especially for those just getting a grip on handling household finances, I’m sharing a free printable budget worksheet set to help you reach your family’s financial goals.

Every January, I go through my Annual Get Organized Checklist to get my house, family, finances, and life in general in order. With one child in college and another on her way in just a couple of years, I’m working extra hard to buckle down on our spending. These budget worksheets and following these Money Saving Tips and Money Saving Tricks will help.

Why Set a Household Budget?

Setting a budget plan is an easy way to track the family’s monthly expenses, savings, and income. It lets you take control of your finances because you track every single dollar of your income so that you know how well you spend your money.

On top of that, it also helps you track financial goals, including how much you’re inching your way toward the goal you’ve set for your savings account.

I understand if you’re not used to handling the finances of an entire family and you only keep track of your personal finances. You may not know where each member’s money is going or how much money you spend as a family unit.

Luckily, this resource provides you with free monthly budget printable templates that will help you get a handle on your finances. You can create copies of these free budget sheets and add them to your budget binder for easy access.

Benefits of Using a Printable Budget Worksheet

Here are a few benefits that you may find useful in the long run:

1. Prepare for Emergencies

While it’s an event we all don’t want to see, emergencies may happen in the future. Your best bet to making it through these situations is by preparing well.

Unfortunately, emergencies can be costly, especially medical ones. However, if you get your budget sorted and have set aside an emergency fund, spending money during an emergency won’t hurt your bank account as much, since you have a budget set for it already.

2. Work Towards a Retirement Fund

When you create a budget, you allocate how much of your household’s income goes to which budget category on a monthly basis. One goal you can set aside money for is your retirement fund. This will accumulate over time, helping lift the burden in the long run.

3. Spot and Curb Bad Spending Habits

A budget acts as your income tracker, expense tracker, and debt tracker, letting you visualize how much you earn and compare it to your debts and spending. This makes terrible spending habits easy to point out. Once you know what these bad habits are, you can set a plan to curb them and work your way towards eliminating them altogether.

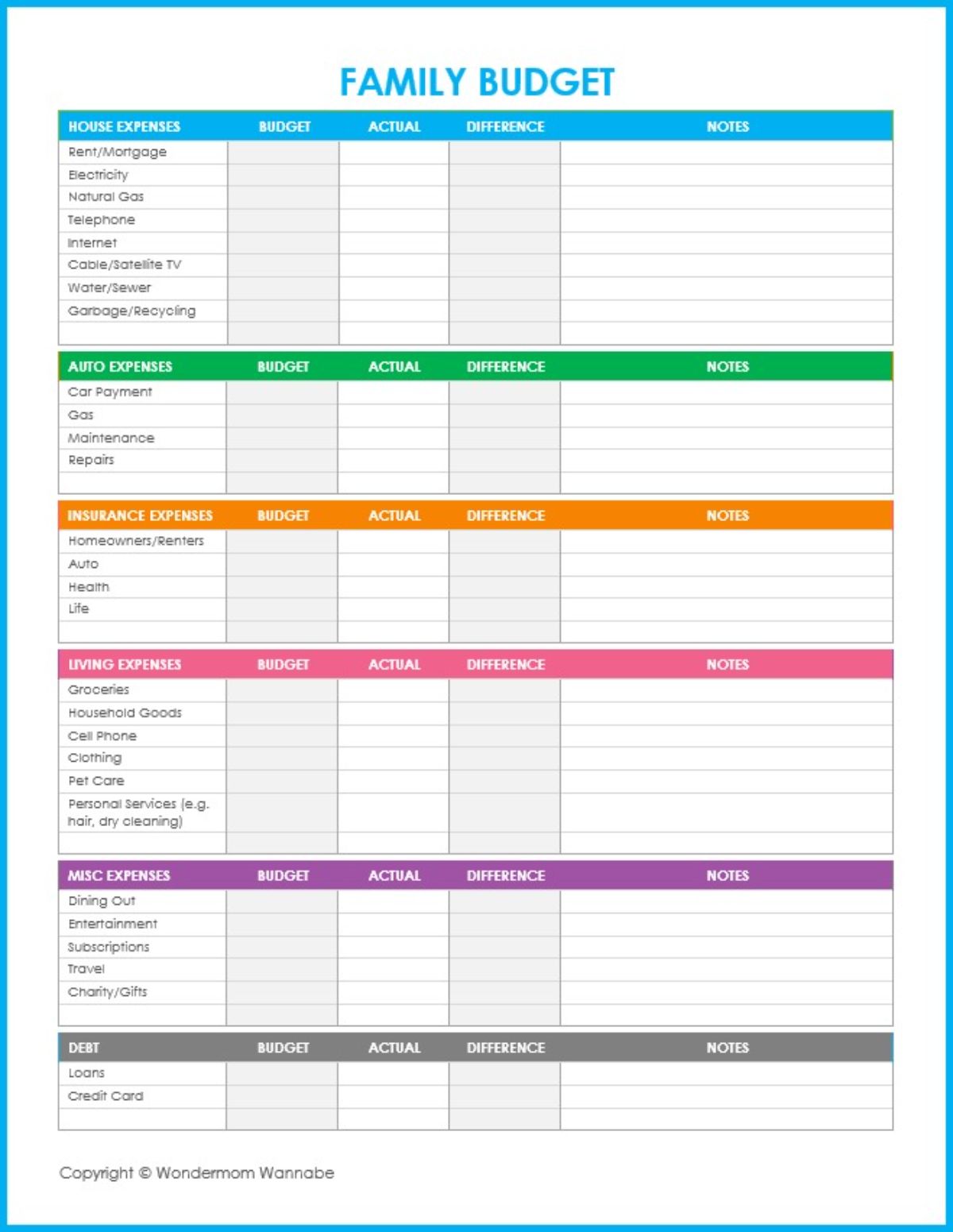

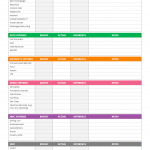

Family Budget Planner

The first and most important step in a financial plan is establishing a budget. Below is the monthly budget template worksheet you can use to establish a budget and track how much you actually spend.

Use the notes section to explain unusual variances between your budgeted and actual expenditures, as well as to jot down ideas or reminders to make changes to trim costs further.

Financial Goals

Many of your costs will be fixed, at least in the immediate future (e.g. rent or mortgage, car payment), but it’s a good idea to set goals or establish guidelines for how much of your income you want to commit to different types of expenditures. If you want to start saving money, this is something you must know to make it easy.

You’ll get a lot of conflicting information on what percentage of your income should be allocated to housing vs. debt. This Recommended Monthly Budget Percentages worksheet from the Michigan Counseling Association is a great place to start setting your spending goals.

Ideally, your monthly income will more than cover your expenses, so you can also set some savings goals. Everyone should have an emergency fund to pull from in case of an emergency so that a tough situation isn’t made worse by adding debt to the stress of whatever unexpected event has occurred. Once you have a comfortable emergency fund, you will probably want to set aside money for holiday spending, retirement, education, vacations, or your dream home.

I’m a big believer in writing down your goals so that you have a greater chance of reaching them. Here’s a savings goal worksheet to help you visualize and progress toward your goals. In the “Goal” column, write down how much you expect to set aside each month for each category (in the “Budget” row) and your goal for the end of the year (in the “End Bal” row). Track your progress over the year. Hopefully, your Ending Balance in December matches your goal!

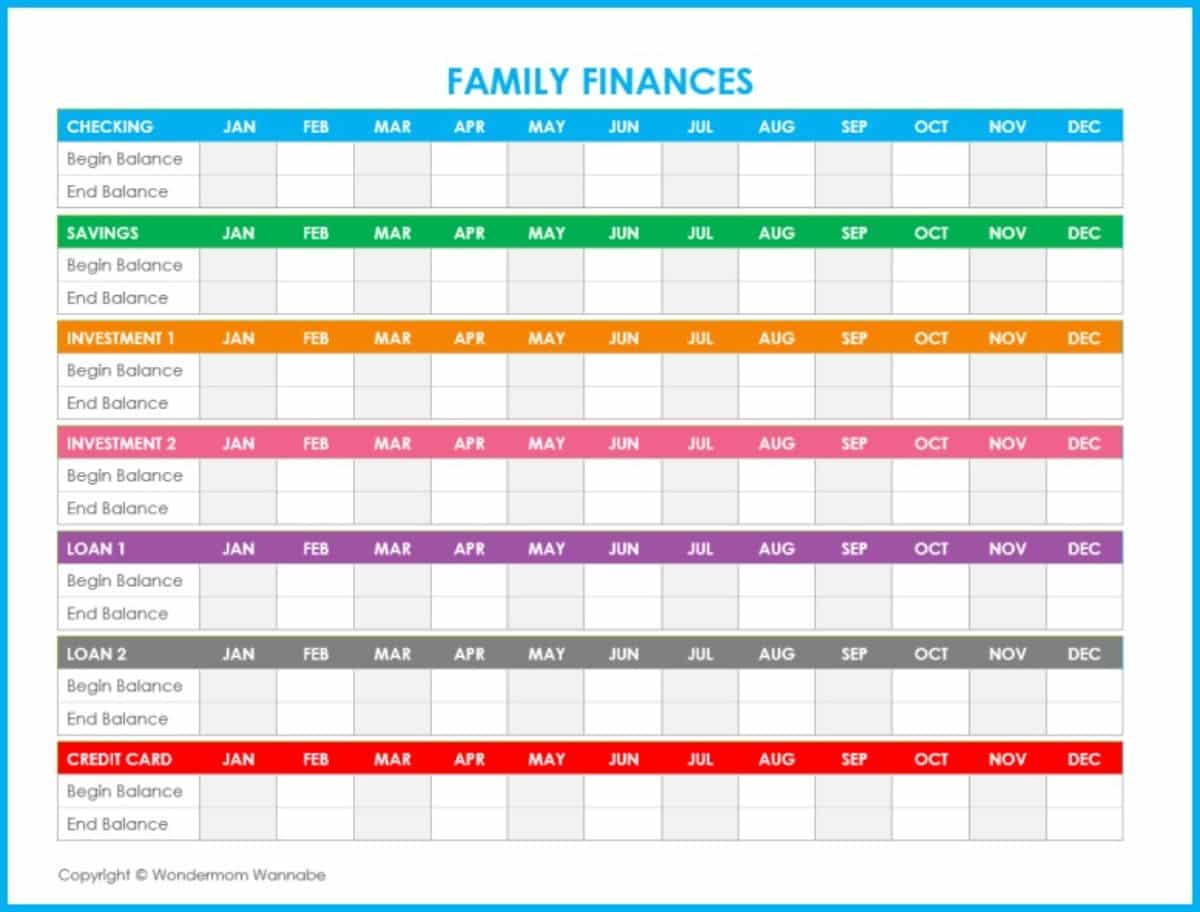

Financial Tracking and Budget Tracker

I am very motivated by seeing progress over time, so I created this next worksheet to watch my savings grow, and my debts shrink over the year. This can help you track your monthly finances by seeing the difference between your balance from the start and at the end of the month.

Helpful Tools

Here are some tools that may be useful if you plan on making copies of these household budget templates.

- Printer: If you’re looking for a budget printer, this one is a good contender. If you intend to spend a bit more on a higher quality product, check this option. But if you’re looking for a heavy-duty, all-in-one machine you can use at home, this one fits the bill, and it has high reviews and comes with 2 years of ink.

- Printer paper or cardstock: If you want to change your budget sheets every month, you may want to print on regular printer paper. However, if you want to reuse the printout for a long time, you may want to print it on cardstock and then laminate it.

- Laminator: Lamination is a cost-effective way for you to use your printable multiple times. First, laminating helps protect your printout. It also creates a surface on which you can write with dry-erase markers and wipe the ink off when you’re done to reuse the printable! Alternatively, you can use clear contact paper to cover your printable and achieve the same thing.

I hope you find these worksheets helpful in setting and reaching financial goals this year. To get all three forms, just click on the form below and have them sent straight to your inbox.

Printable FAQs

Fill in the form above. After you submit the form, you’ll receive an email from “Wondermom Wannabe” with a direct link to the printable. If you do not see the email in your inbox within a few minutes, check your spam folder.

The most likely place will be in your computer’s Downloads folder. You can also select “Downloads” in your browser menu to see a list of your downloads, then simply select “Show in folder” below the file name to see where it is stored on your computer.

You’ll need a program that supports PDFS, like Adobe Acrobat (which is free). Open the program, click File > Print. Select your printer and set the number of copies you want to print. Double check your print preview, then click print.

Prefer a version you can edit? Purchase an Excel file with all three worksheets below.

I don’t see a form to fill out to get the free printable.

You just put your email address on the line in the box for the Free Printable Family Budget Worksheets. Then click the “Yes please” blue button. This box is under the “Helpful Tools” section and above the “Printable FAQs”

How can I print these forms or edit them and save them on my computer?

Fill in the form above. After you submit the form, you’ll receive an email from “Wondermom Wannabe” with a direct link to the printable library where you’ll find the link to the printable above as well as all of my other free printables. If you do not see the email in your inbox within a few minutes, check your spam folder. If it’s in your spam folder, make sure you mark it not spam and move it to your inbox before clicking on the confirmation link.

A great way to get organized.

Thanks, I’m glad you think it’s a good idea. Thanks for commenting.

A great way to get organized. I enjoy having something actually printed out to work with.

Thanks!

You’re welcome, I’m glad you found it helpful. Thanks for commenting.

still haven’t received the access or email. can you send the link or template to these? thanks

Unfortunately some email providers automatically put my confirmation email in spam. When that happens, the link in the email to click to confirm won’t work. If you can find it in your spam, go ahead and mark it not spam and move it to your inbox. I can’t send you a second confirmation email, so I had to go ahead and unsubscribe you from my email. If you are still interested in the printable, subscribe to my email again. Since you’ve already marked one of my emails as “not spam,” this confirmation email should go to your inbox and you should be able to confirm it now. If you need any more help, let me know.

How do i get these worksheets for free?

Fill in the form above. After you submit the form, you’ll receive an email from “Wondermom Wannabe” with a direct link to the printable library where you’ll find the link to the printable above as well as all of my other free printables. If you do not see the email in your inbox within a few minutes, check your spam folder.

Hey Corinne, tried using the contact form, looks like it isn’t loading. Can I possibly share this budget template with my audience? Will link back to this page so they can grab a copy, but I love the look of it!

Thanks!

Jacob Wade

Sure, go ahead and share it with your audience with a link back to my page. Thanks for asking.

Wonderful Ideas for future family affairs.

Thank you for commenting.

Very helpful

Thank you for commenting.

I didn’t get my free family budget templates

When you submitted your email address, it should have taken you to a new page with a button to access the subscriber library. In addition, an email goes out immediately with the link. I checked my email service and can’t find you under the email address you’ve provided here. If you subscribed using another email address, check your promotions or spam folder.

Thank you so much for sharing these tips. I appreciate any help that is available. Thank you again for doing this. What an inspiration.

Hello,

I know it’s a new year but if you read this, will you kindly email the excel version to me.

I sent the e-mail Marjorie. Please let me know if you didn’t receive it.

Love your worksheets! We are on a much stricter budget this year and these will help. Thank you for sharing.

I’m glad you can put them to good use. Thanks so much for taking the time to comment. 🙂

This is something that I really need. I am trying to budget our money better this year.

These look great! Thanks so much!! 2016 is the year I get this budgeting thing figured out!

Thank You! Can’t wait. 🙂

Hi. I just wanted to check to see if you had sent these.. if not yet no worries. I just haven’t seen them and want to be sure it came thru. Thanks so much for your time!

Nevermind… I just found it in my inbox. Thanks so very much!!! So helpful!

I love how clear and simple your worksheet is. It’s important to be in charge of your money not always charging and hoping for money. We have something similar to your worksheet, the only difference is that we put our tithing/charitable giving first.

This is a great idea. I rarely budget because I used to always get more money in than I’d spend and I don’t have any debt. Then again, I’m suspecting it will get harder this year, because of rising costs and lower income. I will give budgeting some thought.