This is a sponsored post written by me on behalf of Navy Federal Credit Union for IZEA. All opinions are 100% mine.

If the pressure of gift giving during the holidays is getting to you, you’re going to love these tips for enjoying Christmas on a budget. You don’t have to make all of your own gifts or sacrifice holiday fun to stick to your budget.

You just need a good plan and a few simple tricks to be frugal AND enjoy plenty of Christmas spirit.

Why It’s Hard to Stick to Your Budget During the Holidays

Even if you’re pretty good at sticking to a budget during the rest of the year, the holidays can really throw your financial plans out of whack. That’s because so many spending opportunities present themselves all at one time.

Instead of shopping for one or two people at a time, like you do for birthdays throughout the year, you’re shopping for several friends and family members at once. Plus, retailers work extra hard to entice you to spend with them so the rock bottom prices and amazing deals are almost too tempting to pass up!

On top of that, you might have travel expenses to visit family or hosting expenses if they’re coming to you. Not to mention all of the fun holiday parties and events you’ll be invited to which will mean hostess gifts, babysitting expenses, and perhaps expenses for meals, transportation and parking.

Depending on where you live, there might be an expectation of holiday tips for services you receive. With so many opportunities and reasons to part with your money, it’s no wonder our holiday spending is hard to control.

How to Establish Your Christmas Budget

One of the biggest mistakes we make when it comes to sticking to a budget at Christmas is that we start with our shopping lists or to-do lists instead of with setting our budget. Your very first step should be to figure out how much you are willing and able to spend for Christmas.

Depending on how you manage your money throughout the year, your method of establishing your Christmas budget can vary. Here are the different methods I’ve used over the years depending on our family and financial situation.

Dedicated Savings

When my first child was born and I rather unexpectedly decided to leave my job and become a stay-at-home mom, our budget took a big hit. Gone were the dual-income glory days of eating out whenever we wanted, driving brand new cars, and spending whatever we wanted on gifts for our friends and family.

With our income cut in half, we had to make a lot of sacrifices and learn to live on a tight budget. Even though we didn’t think Christmas should be all about gifts, we also weren’t ready to part with that part of our Christmas tradition.

We agreed that we would save all of our spare change during the year in a giant 5-gallon water bottle. Whatever we saved in that bottle would be what we used for holiday shopping.

I wish I could remember the exact number, but since it was 20 years ago, that number fails me. I do remember it was over $365 though! I remember that because I was shocked that we had saved more than $1 per day in spare change.

Whether you use spare change, set aside a specific amount each month or pay period, or save your tax refund in a savings account to earn interest all year – if you have dedicated savings for Christmas shopping, your budget will simply be the amount you accumulate before you start your holiday shopping. Visit Making Cents for tips and guidance to build up your holiday savings.

Traditional Budgeting

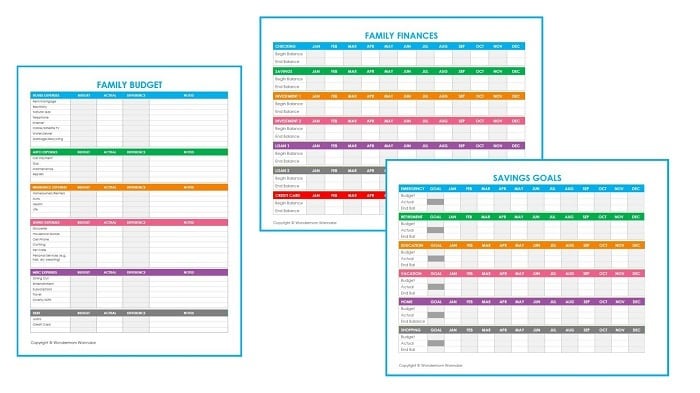

Most years, this is how I determine how much we can spend. I sit down and figure out our income and expenses to find how much flexible spending money we have. This free monthly budget worksheet is a great resource.

Then, my husband and I decide together which things we’re willing to scale back on so we can divert those funds to our holiday budget. Normally, we “borrow” from our dining out and fun money categories.

If we’re unhappy with that number, we’ll look at other categories to see if we can make a few sacrifices or changes to save a few more dollars.

For example, can we save money on groceries by planning more soups or vegetarian dinners? Can we replace disposable items with reusable items to trim ongoing expenses?

The nice thing is, once you shave some of these expenses to divert more funds to your Christmas budget, after Christmas it’s easier to stick to those changes!

Earn More

While an extra job might not be practical in the long-term, given all of the job opportunities during the holiday season it can be a very practical short-term decision. A part-time job at a retailer provides the added bonus of an employee discount so that while earning more money, you can also save on holiday shopping expenses.

Temporary retail jobs are the easiest to come by during the holidays, but they’re not your only option. Many restaurants and catering companies hire extra help during the holidays. Also, due to the number of holiday parties and activities, many parents need babysitters more often.

If you’re crafty, you can create gift items to sell to others. If you’re not crafty, you can sell unwanted items in a yard sale or online.

A side job can either make up your entire holiday budget, a portion of it, or be used for both your holiday budget AND extra savings. It’s entirely up to you how much of your extra income you want to earmark for the holidays.

Important Step!

After you’ve set your budget, the best way to stick to it is to put those funds onto a prepaid card. Then, make a commitment to only use the prepaid card for your holiday spending. You have dozens of options, but look for one like the GO Prepaid Card from Navy Federal Credit Union. Features to look for include:

- No fees

- Fraud protection

- ATM access

Promise yourself that you will use the prepaid card for all of your holiday expenses and when it’s empty, you’re done.

Categorizing Your Christmas Budget

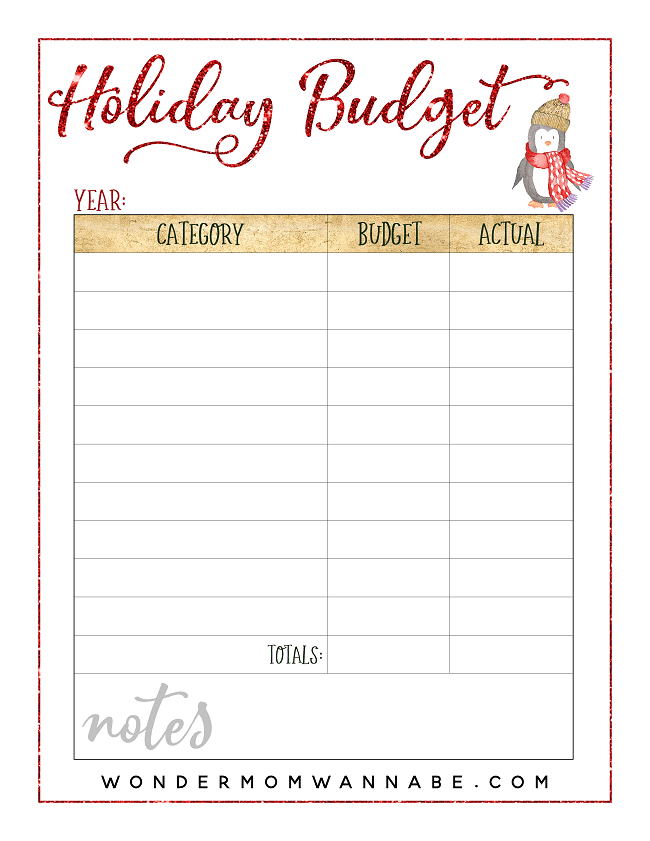

After you’ve established how much spending money you’ll have for holiday spending, you need to divvy it up into categories of holiday spending. These are the categories I use:

- Gifts

- Decorating

- Parties & Holiday Cards

Then, decide how much of your total budget you are going to dedicate to each category. I allocate the majority of our Christmas budget to gifts (70%) and then another large portion for decorating (20%) for our tree, poinsettias, new ornaments and miscellaneous decor items I may find.

The remaining 10% goes towards parties and holiday cards. If I end up overspending on gifts (which I have done), we scale back our holiday parties (we usually host two but may cut back to one). Twice, I just didn’t do holiday cards. Here’s a free printable to help you set up your budget.

Your categories, allocations, and adjustments might be different than mine, depending on what you value and enjoy most. Hopefully this gives you a good place to start though.

How to Buy Gifts for Christmas on a Budget

It’s so much fun to shop for others, especially when you find the perfect gift at a great price! That’s why many of us go off-budget when it comes to Christmas shopping. It is so important to plan ahead!

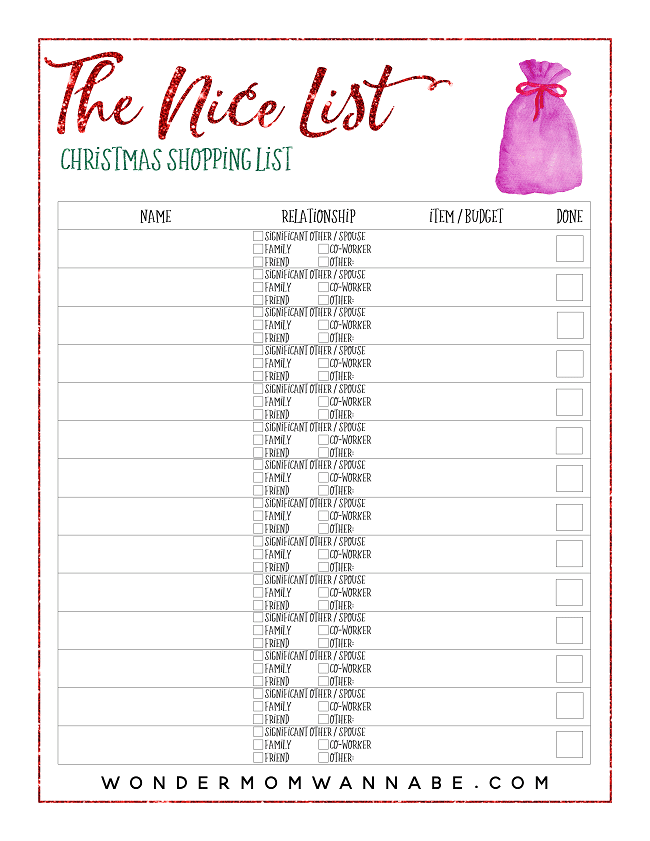

First, make a list of everyone you want to give gifts to. Then, looking at the gift budget you established above, decide how much of your total budget you are going to spend on each person on your list.

Here’s another free printable to help you track your Christmas gift shopping list.

Once you’ve determined the maximum amount you’re going to spend on each person on your list, it’s time to figure out how to get the most bang for every buck. Check out my post “How to Buy Christmas Gifts on a Budget” for several tips!

How to Decorate for Christmas on a Budget

I don’t have a great eye for decorating so I hate to spend money on decorations. The most expensive decoration we budget for is our tree because my husband likes to have a real tree for Christmas.

If you’re willing to do a little work, you can get a real tree for very little by cutting down your own. In some places, you only have to pay a small permit fee.

Check with the U.S. Forest Service for more details. Take the kids on a hike and collect pinecones and evergreen sprigs. Then use them to decorate throughout your home.

- Create a natural wreath

- Create a natural garland

- Place pinecones and sprigs in glass vases or bowls

You can also make a variety of holiday decorations with inexpensive items like:

-

- Cranberries

- Christmas candy

- Popcorn

- Candy canes

- Colored paper

- Wrapping paper

Paired with repurposed items like wine bottles, mason jars, and old holiday sweaters, the possibilities are endless! If you lack creativity (like I do), do a quick Pinterest search for “easy DIY Christmas decorations” to find inspiration and tutorials.

More Tips for Enjoying Christmas on a Budget

Gifts probably make up the majority of your holiday spending and I’ve already shared some tips to save money on your holiday decorating. Even though everything else might make up just a small portion of your budget, it’s those minor expenses that can add up.

Here are some ways to stay within your budget on miscellaneous Christmas expenses:

- Send digital holiday cards instead of printed cards to save on printing and postage

- In lieu of a lavish holiday party, invite friends to volunteer as a group at a local soup kitchen or charity event – It’ll be more fun as a group, and more memorable than noshing on appetizers and cocktails

- If you’re hosting house guests over the holidays, plan frugal meals that feed a crowd like egg-based breakfast casseroles, soups and pasta dishes

- Serve beverages that can be made in large batches (e.g. iced tea and fruit-flavored water) instead of expensive single-serve beverages

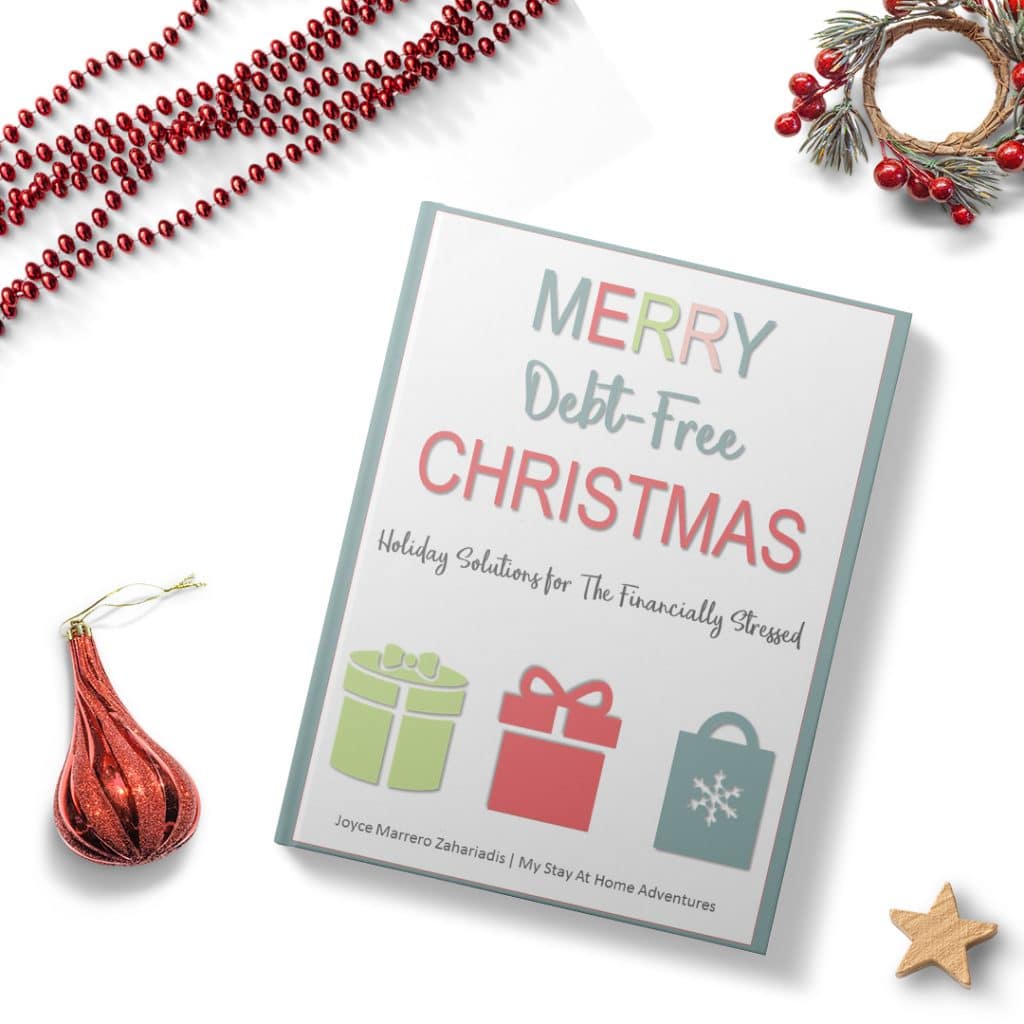

If you’re really committed to making it through the holiday season without incurring debt, check out A Merry Debt Free Christmas. The eBook includes solid advice and clear instructions and the bundle comes with a workbook to help you plan and track your progress and goals.

More Budgeting Help

Of course, good financial health means that we don’t just live Christmas on a budget, it’s a year-long endeavor. A great resource for budgeting and general financial education is MakingCents, Navy Federal’s online resource for financial education. It’s easy to get advice tailored to your current situation.

Also, if you don’t have them already, download my free printable family budget worksheets. They are simple and straightforward but have everything you need to get your family finances in order.

If you want to learn more about Navy Federal, read “Why choose Navy Federal?” for answers to all of your questions.

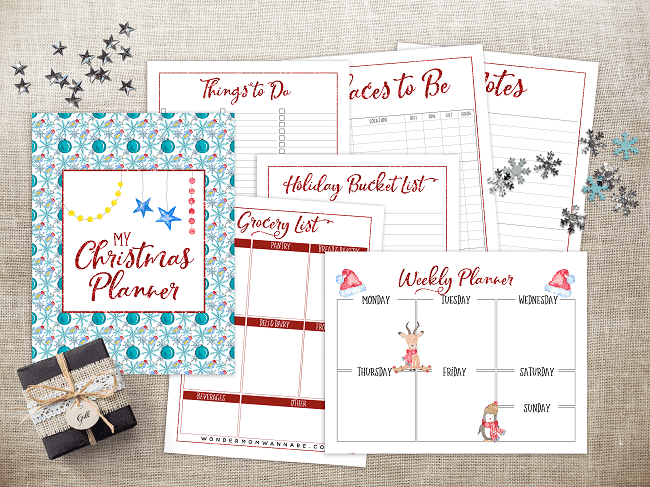

If you want to learn more about Navy Federal, read “Why choose Navy Federal?” for answers to all of your questions.If you liked the free printable sheets I included in this post for enjoying Christmas on a budget, you can read more about the other 14 pages in my Ultimate Printable Christmas Planner by clicking the image below.

Thrive This Holiday Season

Need help getting ready for the holidays? Use one of these printable Christmas planners.

All three have helpful checklists and ideas to help you get and stay organized through the busy holiday season. Each one is a little different so that you can choose the one that works best for you.

I’m a little out-of-season, but this is a great post. I particularly like the prepaid card idea for sticking to a budget – good advice in MANY circumstances, honestly!

I’m filing this away for a few months from now. Thanks for sharing this 🙂