This is a sponsored post for Make Your Kids a Money Genius (Even if You’re Not).

Do you wish there was a way to make your kid a money genius? It would help us nervous moms sleep better, wouldn’t it?

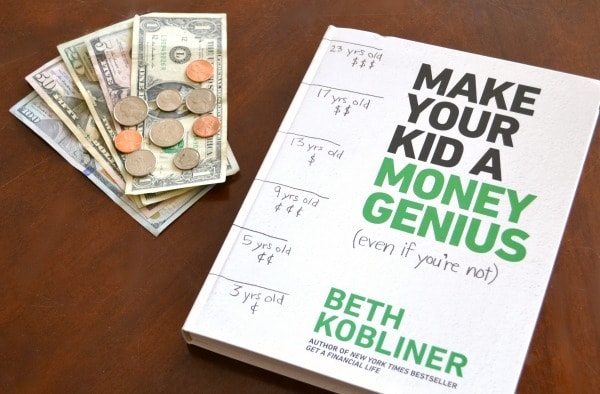

Luckily, Beth Kobliner, renowned for her expertise in personal finance, has written a book called Make Your Kid a Money Genius (Even if You’re Not). It’s an easy-to-understand book to guide you through money topics with your children.

Who is Teaching Your Kids About Money?

My main job as a mom is to raise my children into capable adults. I work very hard to arm them with skills they’ll need to lead independent lives. My husband does his part too, sharing his knowledge and skill with our children. Unsurprisingly, it’s parents that wield the greatest influence over kids’ financial behaviors.

We encourage them to pursue their interests so they can find a career path that will bring them happiness. And we teach them life skills like personal hygiene, cooking, driving, and how to manage their finances.

I consider money management one of the most essential life skills we teach our children. Most people will eventually figure out how to cook and clean and the worse that happens in the learning process is that the house is a little messy or they eat out more often than they should. But if you mismanage your money, it can result in financial devastation that lasts for years.

I hope that the lessons we try to impart about money management outweigh the examples of extravagance and financial irresponsibility they’re exposed to elsewhere. While media, friends, and other adult role models can provide positive lessons, many of them can conflict with our values too.

When Should You Teach Your Kids About Money?

Honestly, talking about finances wasn’t high on my priority list when my kids were little. I did small things that impacted their views of money. For example,

- Having them shop with me and explaining

- Why we use coupons

- Why some items are or are not a good value

- Why we can’t buy whatever we want whenever we want since we have a budget

- Making them save for things they want instead of just buying it for them

- Providing opportunities for them to earn money by doing work

As you can see, my concept of teaching my kids about money was pretty basic.

In Make Your Kid a Money Genius (Even If You’re Not) I learned that our money habits are formed by the age of SEVEN. Seven! I really wish I could turn back the clock and get a do-over. However, since my youngest is 9, I need to address what I can do now. Thankfully the book is full of advice to help me all the way until my kids are 23.

How to Teach Your Kids About Money

Make Your Kid a Money Genius (Even If You’re Not) is based on the latest research from the fields of psychology, child development, and behavioral economics, NOT conjecture. You might be surprised at some of the research results in. I was.

Who knew that doling out a wad of cash could be a brilliant move? Or that you SHOULDN’T open a brokerage account to teach your teen about the stock market but you SHOULD help him or her open an IRA? Oh, and skip the bribes for A’s because it’s a waste of money.

Here’s the good news, that meager effort I’ve been making on the topic of money management hasn’t been terrible. I’ve been sharing my personal finance methods with my kids in a small way all along with those teachable moments.

Most of teaching your kids about money involves having conversations with them about it. Make Your Kid a Money Genius (Even If You’re Not) guides you through those conversations (in super simple, easy-to-understand language) to make sure you cover all of the important areas of personal finance:

- Saving

- Earned Income

- Debt Management

- Spending

- Insurance

- Investing

- Charitable Giving

- College

And that parenthetical part of the title (Even if You’re Not)? Yep, the book walks you through which topics to cover when and how. So, whether your child is 3 or 23, you’ll find relevant information for your family’s situation in each section. Plus, there’s an entire chapter full of advice for you and a list of other books you might want to read to learn more.

Get the Book

Make Your Kid a Money Genius (Even If You’re Not) is available at major bookstores including:

About the Author

BETH KOBLINER is a commentator, journalist, and a leading authority on personal finance for young people.

She’s written for several publications including: Money, Glamour, Redbook, the New York Times, the Wall Street Journal, Reader’s Digest, The Huffington Post, and SheKnows.com. You might recognize her from one of her TV appearances on Oprah, Sesame Street and Good Morning America. She’s also been on National Public Radio’s Morning Edition. She’s also somehow found time to be a regular contributor to MSNBC and NPR’s The Takeaway and Marketplace.

President Barack Obama recognized her financial acumen and thus, appointed her as a member of the President’s Advisory Council on Financial Capability. While serving on the council she created MoneyAsYouGrow.org, a site that offered 20 essential, age-appropriate money lessons for kids. It was so popular, it was adopted by the Consumer Financial Protection Bureau in 2016.

Beth lives with her family in New York City.

Great info available here .Thank you for posting. Hope to learn lots more.

So true! Money management is an essential life skill that I wish was taught in schools.